A venture capital is a type of private equity firm that provides financing and/or funding for early-stage companies and start-ups. The type of companies that are ready to raise funds from a venture capital is those that have shown high amounts of growth and have high growth potential. Raising money through a venture capital could be highly beneficial because it can provide companies with funding and other resources that will help them develop new products or enter a new market.

There are many venture capital firms in this world, but only few that can be called top VC firms in the world.

Read also: Early Startup Funding Stages: Explained From Seed to IPO

The Best Venture Capital in The World

Below is a list of the top venture capitals in the world that have made a large amount of investment:

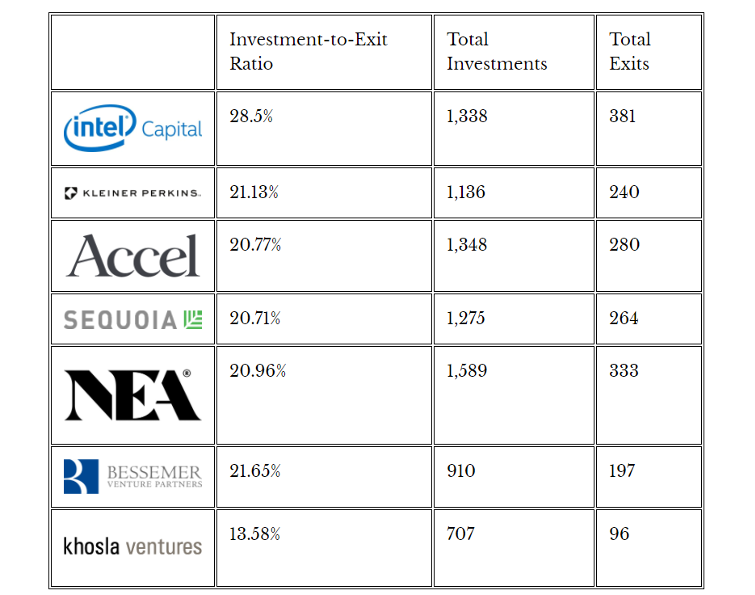

Table 1. Top venture capital in the world (2020)

Source: https://www.universitylabpartners.org/blog/top-venture-capital-firms-2020

List of Top venture capital in the world:

1. Intel Capital

According to the top venture capital firms in the world table above, Intel Capital is the highest ranking company among in the list that has made more than 1,300 investments with an investment-to-exit ratio of 28.5% which amounts to 381 exits. Their main portfolio is technology based start-ups including but not limited to digital business media, software, and hardware companies.

Read also: Seed Funding and Ways to Get Investors for Startups

2. Kleiner Perkins

The second best venture capital in the world is Kleiner Perkins. Ever since it was founded in 1972, they have made a total of 1,136 investments, 240 of which have gone to IPO. While their initial investments focused around software and hardware industries, they have expanded to biotechnology, mobile, healthcare, and internet industries.

3. Accel

The third one is Accel. It was founded in 1983, they have made many notable investments, which includes Dropbox and Facebook. Since their main forte during this are highly versatile risk capital firms that mainly invests in early-stage and growth-stage start-ups.

Read also: The Most Active Venture Capital in Indonesia, Singapore, Asia, and Southeast Asia

4. Sequoia Capital

The fourth top venture capital in the world is Sequoia Capital which was founded in 1972. Their investments are made to private and public companies that are operating in China, India, and Israel. Sequoia Capital has made around 1,275 investments, 265 of which were successful exits for a ratio of 20.71 percent. Being the lead investor, more than 63 percent of the companies that they invested in made it to IPO. Some of the notable exits include NVIDIA and Instagram.

5. New Enterprise Associates

New Enterprise Associates made of 1,589 investments. This venture capital specialise in the technology and healthcare industries with their investments.

Also read: 6 Characteristics of Venture Capital You Need to Know

6. Bessemer Venture

This one of the best venture capital in the world has made 910 investments, thanks to its expansive scope/project.

7. Khosla Ventures

With total 707 investments made, Khosla Venture specializing in providing funds to early-stage start-ups.

In addition to the best venture capital companies above, there are various venture capital companies that are still adding to their portfolio, one of which is Alpha JWC Ventures, one of the best venture capital in Southeast Asia.

Active since 2016, Alpha JWC Ventures has funded more than 70 early-stage startup companies in Southeast Asia. Some of the startups that are included in the Alpha JWC Ventures portfolio are Ajaib, Carro, Finaccel, Kopi Kenangan, Lemonilo, Gudangada, and many others.