Indonesia is Southeast Asia’s largest economy. With the rise of digital technology adoption, Indonesia’s economy is growing at a rapid pace, especially in its tier 2 and 3 cities. This is where the digital revolution is taking place as startups look to harness digital technology to empower small businesses and try to solve the inequalities in economic distribution. Alpha JWC Ventures is one of the region’s biggest venture capital firms (with a strong track record from 2015) trying to build a legacy of working with startups that are purely focused on growing the digital ecosystem in Indonesia.

Chandra Tjan is a successful venture capitalist who is a pioneer among VCs in Indonesia. He has invested in dozens of early-stage startups, including those that have grown to be unicorns like Carro, Kopi Kenangan and Ajaib. Chandra previously co-founded East Ventures and was an early investor and board member of e-commerce marketplace Tokopedia and all-in-one travel booking platform Traveloka.

With over a decade of experience in tech investment, Chandra has invested in more than 100 companies in Asia and the United States, having also inspired multiple companies along the way.

Also read: What is Venture Capital? Definition, Benefits, How It Works

“I got into investing in the very early days because I saw untapped potential in the Indonesian startup market and felt there was a lack of funding, support and a robust ecosystem at that time that allows Indonesian startups and founders to thrive and succeed,” Tjan explains.

And his sentiments were also felt by Jefrey Joe, general partner and co-founder of Alpha JWC Ventures, who was at the same time also looking at the evolving technology ecosystem in Indonesia and the growth of the internet economy. “I studied in Melbourne, Australia, and I started a DVD delivery startup back in 2004 when widespread internet penetration was still in a nascent stage,” said Joe about his beginnings as an entrepreneur who went on to launch businesses in several other sectors prior to Alpha JWC.

After working as a consultant at EY and Boston Consulting Group, and armed with an MBA from UCLA, Anderson, Jefrey made the transition into the startup world, going into the digital space as COO of Groupon, Indonesia which was then one of the largest tech companies in the region.

“After Groupon, I started a bill payment company called Alterra which made me realise that there isn’t much in terms of any support system for startup entrepreneurs and founders in Indonesia,” said the venture capitalist.

Also read: Best Venture Capital in Southeast Asia

“Before I started AlphaJWC, I did a few angel investments and attended conferences in the US, and I saw a robust and mature tech ecosystem in the US. There were angel investors there, incubators like YC. Back then, I think my partner Chandra was one of the very few active investors in Indonesia- which showed how big the gap is in the market. After I met with Chandra, we strongly believed that our complementary skillsets and background could really close the huge gap in the VC space” he remarked.

In 2014 they started to formulate the plan together and by 2015 they officially launched Indonesia’s first independent and institutionalized VC firm. “It made a lot of sense because we believe that Indonesia, as the fourth largest country in the world in terms of population, should have a meaningful role to play in the global technology space,” added Joe.

“We have a big vision, and we think long term. Therefore being an independent and institutional firm is the first basic step for us. Also, my previous experience gave me valuable experience on not just setting up the fund, but how to run it.” Tjan further explained.

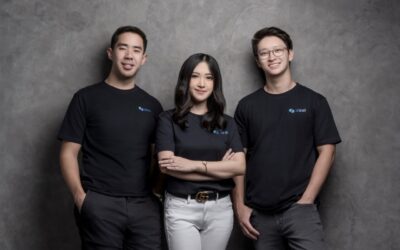

Since beginning in 2015, Alpha JWC founders Chandra Tjan and Jefrey Joe have grown their venture fund to an AUM of US$650 million.

Also read: Early Startup Funding Stages: Explained From Seed to IPO

A VC for the digital economy

As an entrepreneur turned VC, Joe believes the main difference between founding a startup and establishing a VC lies in the depth versus breadth of skills required. “Startup founders need to be focused in one vertical or industry, at least in the early days. While VCs invest and involve in many companies in different sectors. We need to act more like an enabler and value-added partner. Our ultimate goal is to increase the chance of success for entrepreneurs” he explained.

Discussing the challenges faced by a VC, Joe says: “Frankly, I’ve been having a lot of fun. The success rate of startups is low and starting a new business is a lot of hard work. But we thrive and enjoy the process. Our founders know it’s hard but they’re made for the journey. So we all know what we signed up for, and in the process, working with these visionary, ambitious, talented entrepreneurs is a great experience,” expressed the co-founder of Alpha JWC.

Currently, Alpha JWC Ventures has a portfolio of around 70 companies representing USD 650 million in AUM. Joe believes the time is right for global investors to venture into the region: “From those 70’ish companies, more than two-thirds are Indonesia based. So, we are convincing the limited partners (LPs) that this is the right time to put their capital to work in Indonesia and that it’s the right time to invest”

“It took us quite a long time to close the fund because back in 2016, there were no unicorns yet from Southeast Asia to speak of. There were some smaller exits here and there but the digital ecosystem was far from where it is today. We had to do a lot of work to convince people to invest when the ecosystem was not yet mature because not many people believed in our vision. We eventually won over our investors with our mission, strategy, experience, and vision for the Indonesian and regional startup scene,” Joe elaborated on the challenges of starting as a VC.

While they are backing a lot of Indonesia-focused companies, when startups want to expand regionally, Tjan explained, “We either have direct access to investors across Southeast Asia or are one degree away from everyone in the space. So our network is one of the key assets because of how we have set up the fund. On the other hand, if any of the foreign startups would like to expand to Indonesia, we can definitely help them as we have done with other companies before.”

Differentiating Alpha JWC from other VCs

“Because we are entrepreneurs ourselves and both Indonesian, that is another unique positioning for us. I know the challenges in the space from the operational standpoint and the market standpoint. For example, how people inspect used cars before they buy in Japan, the US, India, China, or Indonesia are all different. The level of trust and the level of transparency in the market is different,” says Joe.

Being local, the Alpha JWC founders understand a lot about the market and that has contributed to the company’s success and how they build their team. They are not resting on their laurels in terms of performance but are on track to becoming one of the best-performing funds in the region.

Chandra says. “We invest in a laser-focused manner. Many funds larger than us usually come in at the Series B stage. Because we can lead from the seed stage up to Series B, we have a very tangible differentiation. It gives the founder many benefits when taking our capital because we can continue to support them in future rounds,” he pointed out.

Chandra believes that beyond their investments their firm adds value in additional ways: “We continue to lend support through our Alpha-X team when it comes to talent, organisation, marketing, branding and communications. Beyond that, we work side by side with our founders to set strategic direction, and mentorship, and also let them tap into our strong network of partners so that they can benefit and increase their chances of success,” he says.

“We have already been in the market for eight years, so the track record and reputation are certainly there. I can tell you how we add value. But our founders have spoken on our behalf many times with their testimonials,” remarked Joe.

While he admits the current economic outlook is uncertain, there is still value to be created here in Southeast Asia. “That’s why we need to be disciplined in terms of the valuation of early-stage startups. We need to focus on the right way and we always advise our startups to focus on getting their product and market fit right, get your fundamentals strong so that it can ride through good and bad market conditions.”

Joe further elaborated: “We always see what the right thing to do for the founders for the long term. We are long-term-minded and will still be here no matter what.”

Alpha JWC believes that you must build the right team that can spend enough time to understand the company. “We know about operations and execution, and because we are seeing a helicopter view of what’s happening in the market, locally and internationally, we can give founders valuable insights that are critical in shaping their business strategy,” he explained about their approach when it comes to advising startups.

Speaking about how they measure success, he said the metrics are black and white. “Our IRR are absolute and they are very precise. In terms of all those metrics we publish, it’s easy for you to see how we are performing, which a lot of our LPs are very happy with. For our founders, how do we measure success? We put a lot of emphasis on being a great partner to our founders, and we know that we have done a great job when our founders believe that we have made a meaningful impact in increasing their chance of success,” he added.

Putting Indonesia on the world map

In concluding the interview, Tjan remarked: “We want to put Indonesia on the map by creating value for investors along the way and making a lot of impact through what we do. Indonesia has a lot of potential and we want to make Indonesian startups known in a global space.

With his decade of experience in tech investments as one of the first Indonesian venture capitalists, Chandra knows how important it is to actively guide their portfolio companies.

“Our founders’ successes are our successes. We only do well if our founders do well. With that said, we are still in the early days and we can’t wait to see how this ecosystem will evolve in the next couple of years and hopefully, Alpha JWC could play an important role in guiding the next generation of successful entrepreneurs in building greater impact and legacy for Indonesia and maybe the world too”, Tjan added.

This article is originally posted on e27. Read the original post here.