The impending IPO following the merger of the country’s two most valuable tech giants Gojek and Tokopedia could set the tone for a spate of exits in the region, according to economist and former Indonesian finance minister Dr Chatib Basri.

Speaking during DealStreetAsia’s webinar titled – Move fast and make things : Big ideas, funds and confidence power Indonesia’s digital business and economy – Dr Basri highlighted the fact that a “strong financial service offering” emerged as a common thread among many firms in the region seeking an IPO including Grab, which inked a $40-billion SPAC deal with Altimeter Growth Corp in April.

This trend, Dr. Basri reasoned, is because financial services provided avenues for monetization. Citing the example of Gojek’s cap table, he pointed out the confluence of investors that represent telecom, e-commerce, ride-hailing and banking. He said “this is the perfect combination because, in the future, you need a collaboration between telco, banking, and tech.”

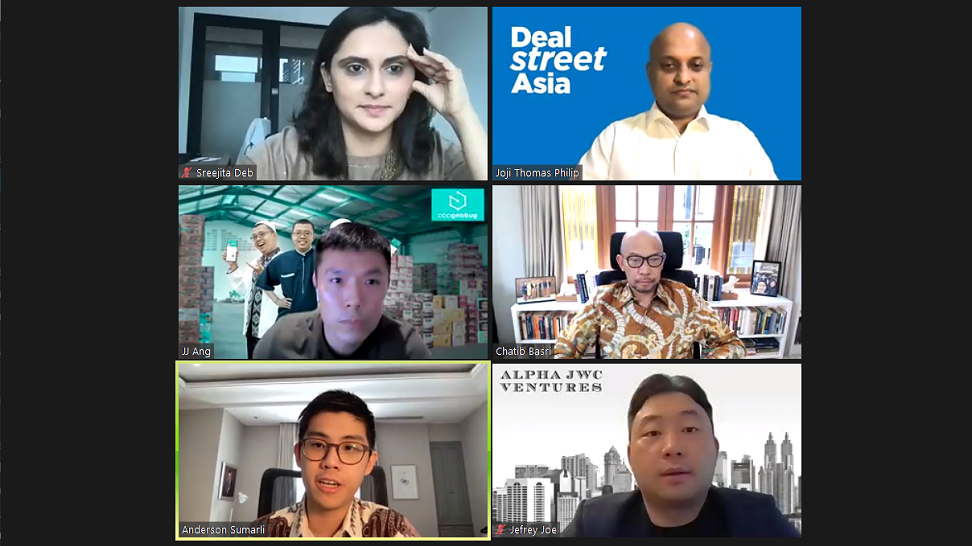

To deliberate on the big ideas that power Indonesia’s digital potential, Dr Basri was joined on the webinar panel by brokerage platform Ajaib co-founder Anderson Sumarli, B2B tech startup GudangAda CFO JJ Ang, social commerce startup Raena co-founder Sreejita Deb, and Alpha JWC co-founder Jefrey Joe.

With the millennial demographics driving Indonesia’s post-pandemic recovery, even traditional businesses are jumping on the digital bandwagon. These macro trends are fueling Indonesia’s startup and venture investing landscape as more and more funds chase pandemic-resilient bets.

The Milenial Impact

As Southeast Asia’s largest market, Indonesia contributes 40% to the regional internet economy. And a lot of this growth is driven by a millennial audience across sectors as diverse as social commerce and stock trading.

With an average working population aged around 26 years in Indonesia, the pandemic-led volatility in the labour market resulted in many individuals diversifying their income streams.

Their (millennials) familiarity and comfort level with social media helped them create and monetize content through commerce, according to Raena’s Sreejita Deb, who spoke about the transformative impact this demographic had on her business.

Raena, which recently raised $9 million in its Series A round, is a marketplace for independent retailers who lack the supply chain of more well established brands. Deb said, “Millennials discover products through Instagram and marketplaces, and a lot of times the supply chain hasn’t kept up.”

Connecting the millennial audiences with smaller brands led to 60% organic downloads and a high level of net revenue retention, she added.

Brokerage platform Ajaib too saw a spike in its customer base largely on the back of first-time users. Interestingly, Ajaib raised a $65-million Series A round led by Robinhood app-backer Ribbit Capital in March, as investors show bias towards online brokerages.

While Indonesia is one of the largest capital markets in the world – with over half a trillion dollars in market capitalization – only 1% of the population invested in stocks. Ajaib was building its base of young, first time investors by making it easier to trade. A key factor was empowering the audience with enough information to make them feel comfortable participating. In the process, Ajaib shot up the ranks to become the fourth most active brokerage in Indonesia by March 2021, with just under 4 million transactions.

Addressing this sharp rise, Ajaib’s Sumarli said, “Part of this is because of the pandemic but another has been accelerated by it. People had started opening accounts online as opposed to going to branches for a couple of years, but the shift was incredibly accelerated by lockdowns. Similarly, customers knew they needed financial planning but, due to the pandemic, unfortunately, people may have been impacted financially. They’re starting to realize the importance of thinking ahead, investing for the long term, and moving on from just consumption behavior.”

Bridging the digital divide

While the pandemic-induced online adoption led to changes in consumer behavior in the way they shopped for goods and services, it also pushed traditional merchants to embrace technology.

Retail-oriented B2B tech platform GudangAda’s JJ Ang said, “The pandemic has accelerated traditional merchants to switch the business from offline to online. The incumbent distribution model has become increasingly inefficient and expensive. This is significant considering that GudangAda operates in a very traditional, fragmented industry, unused to online transactions. And added, “It requires merchant education along with the right layering up of service offering to lock in stickiness. The acceleration and the need for technology adoption for merchants are undeniable, and ultimately benefits us tremendously.”

Ang claimed that GudangAda had increased its net merchandise value as well as its number or registered users 10 times year on year in 2020. Annual orders were up 14-15 times versus 2019.

GudangAda is close to wrapping up a $75-million Series B round soon, as reported by DealStreetAsia last month.

Sharing the investor perspective on the fundraising landscape for pandemic-resilient bets, Jefrey Joe said, “When companies did raise funds, the rounds tend to be bigger and more oversubscribed, compared to the pre-COVID level. In the quality – only founders daring enough start a company through difficult times.”

When it came to Series A and above, companies with good traction benefited, thanks to liquidity in the system and a flight towards quality. “Even companies who are not doing too well are getting funding if the narrative is about how they are holding on and have managed. The revenue may be down, but it’s not a bad place to invest. If there is a comeback, they will be better, stronger and have less competition.” added the Alpha JWC co-founder.

Regulatory Landscape

As the startup ecosystem in Indonesia matures leading to the creation of more unicorns and mature enterprises, the regulatory landscape also need to keep pace to foster innovation.

“I have to admit that a always lag behind innovation. This is especially true of new paths to IPOs like SPACs. Since these vehicles are new, we probably still have steps to learn about SPACs or how to do tech IPOs.” Dr Basri observed.

He emphasized the need for increased engagement between market players and regulators. This will help regulators to bring about a shift from “agree on rules to agree on principles.”

This article is published by DealStreet Asia, read the original article here.