The Beginning

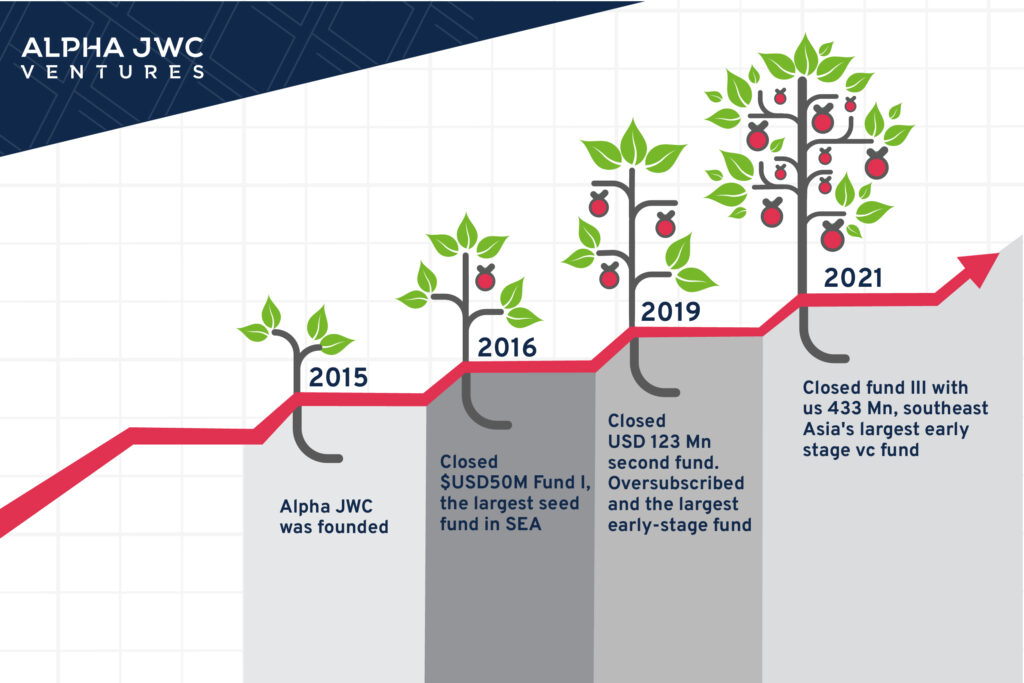

In an office space big enough for only two desks but not big enough to contain their ambitions, Jefrey Joe, Chandra Tjan and Will Ongkowidjaja launched their company in 2015 armed with nothing more than their extensive experience, passion, and drive. Fast forward 7 years to 2022, they now have a team of almost 40 staff between Singapore and Indonesia, and recently raised USD$433m in funding, bringing their total funding to USD$650m.

No, this is not a story of a start-up and its founders, this is the story of Alpha JWC Ventures, Indonesia’s first independent and institutional VC firm that grew into Southeast Asia’s largest early-stage fund.

Indonesian born, Southeast Asian bred

Founding partners, Jefrey Joe and Chandra Tjan noticed that the Indonesian startup scene was bubbling with activity and great potential, and through their networks and conversations, also saw that there were more Indonesians taking on the entrepreneurial journey. Seeing a gap in support and funding for the Indonesian startup scene, Alpha JWC Ventures was launched in 2015 as the first independent and institutional VC firm in Indonesia.

With Jefrey Joe and Chandra Tjan both born and bred Indonesians, and so with the initial team, the firm is able to tap into its deep and native understanding of the largest economy in Southeast Asia when it comes to investing decisions and also helping its portfolio companies.

Fast forward a few years later, not only has the team expanded but so has the geography of growth, investment, and focus – branching out into SEA. The firm now has a base in Indonesia and Singapore, filled with a team that boasts regional and global experience in different fields. The growth was spurred by the burgeoning and blossoming startup scene in Southeast Asia that saw many unicorns emerge in a shorter time in recent times. Alpha JWC saw three of its portfolio companies achieve unicorn status in the last two years: Ajaib, Kopi Kenangan, and Carro.

Also read: What is Venture Capital? Definition, Benefits, How It Works

The expansion was not just geographic. Alpha JWC also grew its network ties and has the privilege of working with great partners such as Kearney, Credit Suisse, AWS, Paypal and top universities across the region. It has also co-led many fund raising rounds with other VC firms such as Sequoia, DST, Softbank, and Northstar just to name a few. Naturally then, it now wears the lens of identifying startups not just in Indonesia but also across the region.

More than a VC

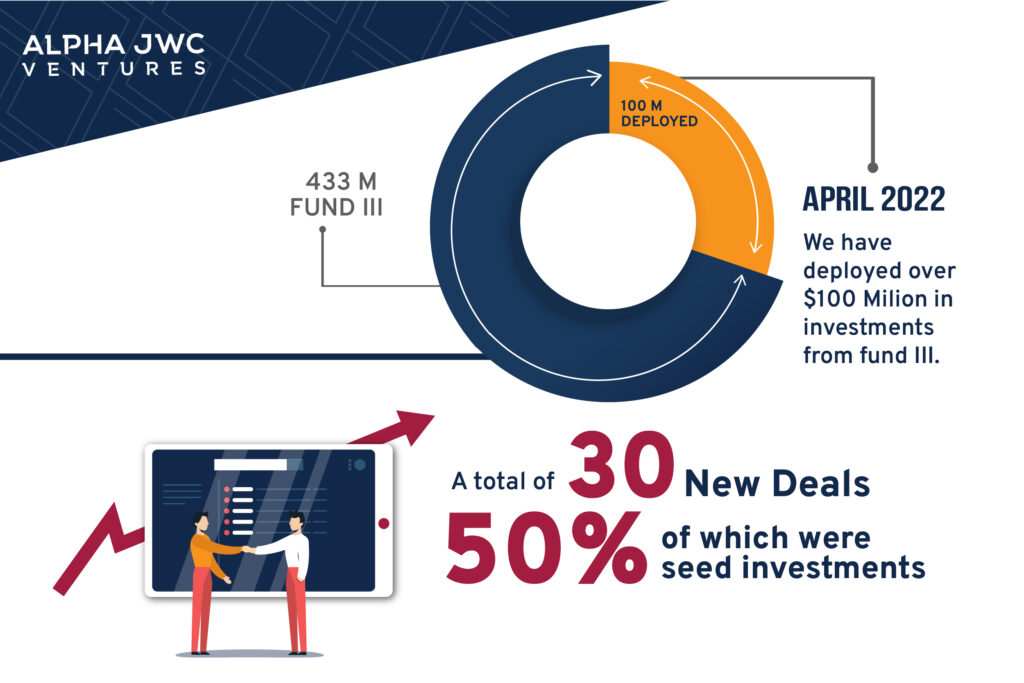

The venture capital ecosystem is in a more mature stage now compared to circa 5 years ago. Valuation and evaluation are more meaningful, and there is more capital available to founders these days. Off the back of a hotbed of growth, innovation, and entrepreneurship, Alpha JWC Ventures raised its oversubscribed third round of funding in 2021 at USD$433m, bringing its total AUM to USD$650m, and making it the largest early-stage fund in SEA, investing as low as USD$100K in early-stage rounds.

But times have changed. Founders’ missions are not just to drive revenue or raise funds, it boils down to making a lasting impact and driving positive changes in their societies. It may be easier to raise funds now compared to before, but that means more emphasis is now placed on VC and founder relations, and what other value adds a VC can give a founder. Funding may be the dealmaker, but the nature and value of the partnership is the dealbreaker.

This as a result shapes how Alpha JWC makes investment decisions and sees its role in the journey of startups it invests in.

Alpha JWC Ventures is a pioneer in its area of value creation for its portfolio companies since 2015 because it believes that startups need more than just capital injection for sustainable growth and impact. The firm has a growing strong team in value creation that works with portfolio companies in the areas of Organisation Planning, Talent hiring, Compensation Benchmarking, and Strategic Marketing & Communications amongst other support that would benefit each startup.

More importantly, Alpha JWC is also the friend that each founder needs- someone who is supportive but equally unabashed when it comes to giving feedback. The teams have tried every dish, every app, every coffee, and every service so that they can give their most candid/honest feedback to help the founders get better.

Also read: Main Role of Venture Capital on Startup Business

Founders maketh the deal

Before Alpha JWC makes an investment, it determines a sound valuation of the startup by looking at growth projections, financial feasibility, and product-market fit. The firm does this by looking at a lot of data points and tapping into its deep market understanding and experience in the Southeast Asia landscape to assess if an idea would succeed. Or not.

However, the most important assessment is not so quantifiable because it focuses on the founder. Great emphasis is placed on the founder’s clarity of thought and the ability to maintain it in all situations to achieve key goals and lead a team. In the startup journey that is fraught with changes and challenges, the founder’s vision and finesse in taking action, and making tough decisions will either steer a startup to success or oblivion.

Case in point. For Indonesian F&B unicorn Kopi Kenangan, the founders were very clear from the start that they wanted to build their own coffee brand through owned physical outlets without franchising. They strongly believed that was the way to control product quality and scale. However COVID hit and with Indonesia on a lockdown, footfalls at Kopi Kenangan outlets dropped considerably.

The thought was that having so many physical stores was a bad idea and COVID ‘proved’ it. However, instead of shuttering down stores entirely, the team instead opened new kiosks near high human traffic places such as gas stations and developed new product offerings such as the Cerita Roti, Chigo fried chicken, and cheap instant coffee. The ability to think and adapt quickly yet remain focused made sure the brand continued to see sales and make it out of the worst times of COVID almost unscathed.

Another example of founders displaying clarity of thought is another unicorn, Ajaib. Its founders were very focused on serving the underbanked and millennials in Indonesia. That focus spurred them to deliver a trading platform that is incredibly easy to onboard and use for retail investors. They were very clear on what needed to be done and how to do it. The result? They are one of the fastest to reach unicorn status in less than 3 years.

Also read: Lean Startup Method: Purpose, and The Basic Principles

The currency of trust

Aside from capital injection, the biggest currency where value and worth lies is in the mutual trust between Alpha JWC and its portfolio companies. People often forget that before the funds are invested, there first has to be trust between both parties to believe that each is the right partner for the other. The portfolio company has to trust that Alpha JWC will give its support and best efforts to open doors and help make things happen for growth, and for Alpha JWC to uphold its integrity in making sure that the firm does the right thing over short term gains.

Only where there is trust would a term sheet even be considered and signed. But it does not stop there. Where trust is given at the beginning, it continues to be earned in the entire journey of the partnership.

Alpha JWC also places great trust in the founders it invests in. This explains why it is an active investor in early-stage startups since its inception in 2015- approximately 50% of Alpha JWC newly signed companies for its Fund III alone are seed/pre-seed investments. This shows great trust is placed on the capabilities and vision of the founder over the idea itself since in the early stages there usually is not much revenue or numbers information to assess an idea on. In addition, 90% of founders (from Funds I and II) went on to receive follow on funding from the firm.

What’s next?

Alpha JWC has its sights set on the Southeast Asian market, and one foot on the accelerator. It believes that this is the golden period for SEA founders to be at the forefront and for startups to take their place on the global centre stage. As the firm drives through the ups and downs and long windy roads of entrepreneurship, along the way it hopes to pick up founders who wish to make a legacy impact in the world and help drive them to success.

This article is originally posted on TechCrunch. Read the original article here.