“To know whether a VC is doing a good job is not by looking if they have Go-Jek or Tokopedia in their portfolio companies, but whether they have a consistent performance.”

Indonesia has a vibrant startups scene with already four out of seven unicorn in the region. However not many saw that potential nine years ago. In 2010, Chandra Tjan, 39, was among the few who see the potential of the digital economy in Indonesia and the trends in the U.S. and China could repeat in the country. Local startups like Tokopedia also started to emerge at the time, but finding financing was still not easy.

Looking at the opportunity, that year Chandra decided to quit his job, moved in to Jakarta, and started the pioneering tech investor East Ventures with Batara Eto, and later with Wilson Cuaca and Taiga Matsuyama. However he was the only partner that is based in Indonesia. Before setting up East Ventures, Chandra was in the banking sector for nearly ten years, working at Credit Suisse and Citi Group in Singapore. East Ventures raised their first fund of just S$3 million and invested in more than 30 companies including Tokopedia and Traveloka– he is still the director of East Ventures Fund 1 until today. Chandra was the first board member in the two startups in the early days for a few years. Now, that first fund net asset value (NAV) has multiplied by an amazing 20 times the initial investment (20X). Until now, Chandra still holds shares in both unicorns.

Unfortunately the team split. Chandra decided to leave East Ventures after raising his fourth fund back in 2014, only to return a year later in the business with a new venture capital (VC) outfit: Alpha JWC Ventures. Alpha is an independent and Indonesia-focused early stage VC. Chandra co-founded Alpha with Jefrey Joe, 35, and Will Ongkowidjaja, 40, in early 2015. While Chandra has a strong banking background, Jefrey who was the COO of Groupon Indonesia and co-founder of Alterra is a more hands-on operation guy. Will, on the other hand, has a balanced experience in the investment banking and consulting firms – he was a director at UBS and prior an associate at Mckinsey & Company.

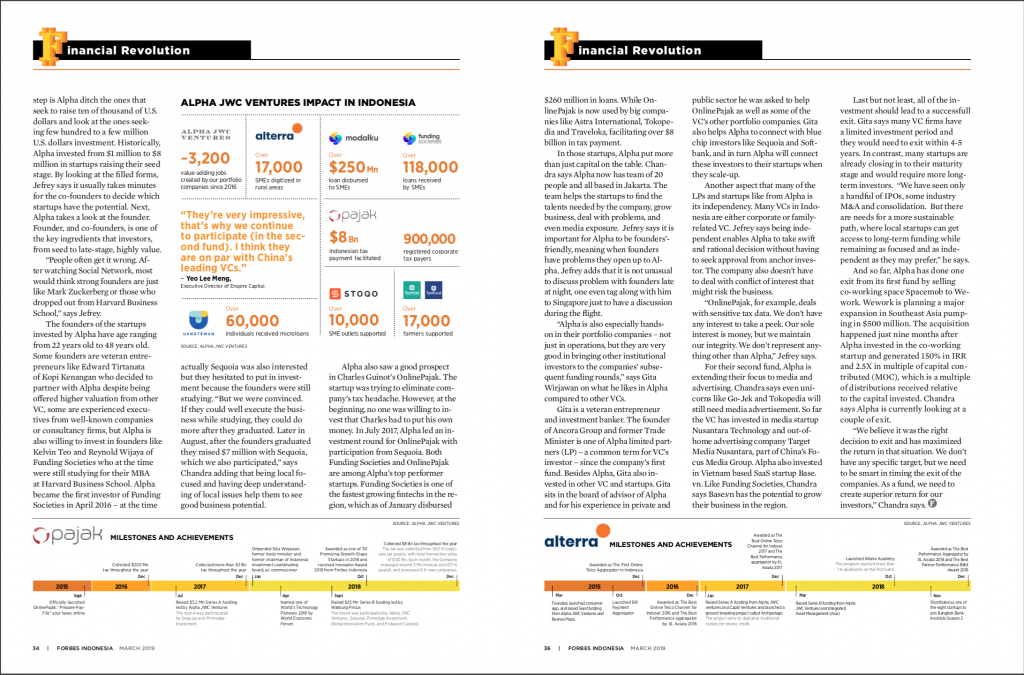

E-commerce was booming at the time, but Alpha decided to deploy their $50 million first fund raised in 2016 on what they think will be the next big thing: fintech, software as a service (SaaS), and big data. In total, Alpha had invested in 23 companies from its first fund including in peer-to-peer lending Funding Societies, fintech Kredivo, mobile credit recharge platform Alterra (previously Sepulsa), taxation solutions SaaS startup OnlinePajak, romance and health products e-commerce Asmaraku, second-hand product market Jualo, and big data company Dattabot. The strategy served the company well. Data from Pitchbook showed that the average top performing fund in the U.S. achieved the NAV of 2.6X after seven years. However, Alpha’s first fund has reached the NAV of 2.6X in less than three years, the figure put Alpha’s first fund performance in the top decile or at least above the top quartile category.

From the 23 companies invested in the first funds only one failed and burned a small investment worth $40,000 or 0.1% of the fund size. In less than three years, Alpha also managed to build up the companies’ valuation to over $1.3 billion, while attracting international investors such as from China, Japan, U.S. as well as from Indonesia.

“Many perceived investing in VC is like gambling, you invest in ten, and one or two might succeed and the other failed. We want to change that perception, we want to set a benchmark,” says Chandra.

VC itself is a relatively new industry in Indonesia, which gained much traction with the growing digital industry. Data published by Google and ATKearney in 2017 showed that VC investments in Indonesia in 2016 is merely 0.15% to the GDP, lower than Southeast Asia average of 0.28%. On the other side, this shows huge room for growth, especially if given incen- tives and policy that foster the digital startups industry. VC also plays an important role in the startup ecosystem. As an alternative investment, VC may pay off high yield return in the long run compared to other investment, but risk is also very high – which suit more for advanced investor. Cambridge Associates, a global investment firm based in Boston, tracked the performance of venture investment in 27,259 startups between 1990 and 2010. Its research reveals that around 60% of the startups failed. Last year Alpha launched its second fund with $100 million target and added seven new startups in its inventory and it still aims to maintain a survival rate of over 90% for its investment.

“They’re very impressive, that’s why we continue to participate (in the second fund). I think they are on par with China’s leading VCs,” says Yeo Lee Meng, Executive Director of Enspire Capital. Enspire is one of the largest Singapore family office funds that invest in VCs and direct investment in China and Silicon Valley, founded by Singapore technology entrepreneur K.S. Chay. Enspire has been with Alpha since the first fund.

“To know whether a VC is doing a good job is not by looking if they have Go-Jek or Tokopedia in their portfolio companies, but whether they have a consistent performance. But we do still aim for the home run,” Jefrey says.

To maintain such consistency, Alpha is very strict to its investment philosophy and strategy. In the past one and a half year, Alpha received over a thousand inbound deals – these are proposals coming from sources like LinkedIn and email introductions. All inbounds get the same treatment, they have to fill a Microsoft Excel form that basically tries to find out three things: how much fund they want to raise, who the existing investors are, and the startup track record performance and traction. Outbound deals coming from reference, which now account about 10% of the deal source, also have to give a pitch deck.

First step is Alpha ditch the ones that seek to raise ten of thousand of U.S. dollars and look at the ones seeking few hundred to a few million U.S. dollars investment. Historically, Alpha invested from $1 million to $8 million in startups raising their seed stage. By looking at the filled forms, Jefrey says it usually takes minutes for the co-founders to decide which startups have the potential. Next, Alpha takes a look at the founder. Founder, and co-founders, is one of the key ingredients that investors, from seed to late-stage, highly value.

“People often get it wrong. After watching Social Network, most would think strong founders are just like Mark Zuckerberg or those who dropped out from Harvard Business School,” says Jefrey.

The founders of the startups invested by Alpha have age ranging from 22 years old to 48 years old. Some founders are veteran entrepreneurs like Edward Tirtanata of Kopi Kenangan who decided to partner with Alpha despite being offered higher valuation from other VC, some are experienced executives from well-known companies or consultancy firms, but Alpha is also willing to invest in founders like Kelvin Teo and Reynold Wijaya of Funding Societies who at the time were still studying for their MBA

at Harvard Business School. Alpha became the first investor of Funding Societies in April 2016 – at the time actually Sequoia was also interested but they hesitated to put in investment because the founders were still studying. “But we were convinced. If they could well execute the business while studying, they could do more after they graduated. Later in August, after the founders graduated they raised $7 million with Sequoia, which we also participated,” says Chandra adding that being local focused and having deep understanding of local issues help them to see good business potential.

Alpha also saw a good prospect in Charles Guinot’s OnlinePajak. The startup was trying to eliminate company’s tax headache. However, at the beginning, no one was willing to invest that Charles had to put his own money. In July 2017, Alpha led an investment round for OnlinePajak with participation from Sequoia. Both Funding Societies and OnlinePajak are among Alpha’s top performer startups. Funding Societies is one of the fastest growing fintechs in the region, which as of January disbursed $260 million in loans. While OnlinePajak is now used by big companies like Astra International, Tokopedia and Traveloka, facilitating over $8 billion in tax payment.

In those startups, Alpha put more than just capital on the table. Chandra says Alpha now has team of 20 people and all based in Jakarta. The team helps the startups to find the talents needed by the company, grow business, deal with problems, and even media exposure. Jefrey says it is important for Alpha to be founders’- friendly, meaning when founders have problems they open up to Alpha. Jefrey adds that it is not unusual to discuss problem with founders late at night, one even tag along with him to Singapore just to have a discussion during the flight.

“Alpha is also especially hands-on in their portfolio companies – not just in operations, but they are very good in bringing other institutional investors to the companies’ subsequent funding rounds,” says Gita Wirjawan on what he likes in Alpha compared to other VCs.

Gita is a veteran entrepreneur and investment banker. The founder of Ancora Group and former Trade Minister is one of Alpha limited partners (LP) – a common term for VC’s investor – since the company’s first fund. Besides Alpha, Gita also invested in other VC and startups. Gita sits in the board of advisor of Alpha and for his experience in private and public sector he was asked to help OnlinePajak as well as some of the VC’s other portfolio companies. Gita also helps Alpha to connect with blue chip investors like Sequoia and Softbank, and in turn Alpha will connect these investors to their startups when they scale-up.

Another aspect that many of the LPs and startups like from Alpha is its independency. Many VCs in Indonesia are either corporate or family-related VC. Jefrey says being independent enables Alpha to take swift and rational decision without having to seek approval from anchor investor. The company also doesn’t have to deal with conflict of interest that might risk the business.

“OnlinePajak, for example, deals with sensitive tax data. We don’t have any interest to take a peek. Our sole interest is money, but we maintain our integrity. We don’t represent anything other than Alpha,” Jefrey says.

For their second fund, Alpha is extending their focus to media and advertising. Chandra says even unicorns like Go-Jek and Tokopedia will still need media advertisement. So far the VC has invested in media startup Nusantara Technology and out-of- home advertising company Target Media Nusantara, part of China’s Focus Media Group. Alpha also invested in Vietnam based SaaS startup Base.vn. Like Funding Societies, Chandra says Base.vn has the potential to grow their business in the region.

Last but not least, all of the investment should lead to a successful exit. Gita says many VC firms have a limited investment period and they would need to exit within 4-5 years. In contrast, many startups are already closing in to their maturity stage and would require more long-term investors. “We have seen only a handful of IPOs, some industry M&A and consolidation. But there are needs for a more sustainable path, where local startups can get access to long-term funding while remaining as focused and as independent as they may prefer,” he says.

And so far, Alpha has done one exit from its first fund by selling co-working space Spacemob to WeWork. WeWork is planning a major expansion in Southeast Asia pumping in $500 million. The acquisition happened just nine months after Alpha invested in the co-working startup and generated 150% in IRR and 2.5X in multiple of capital contributed (MOC), which is a multiple of distributions received relative to the capital invested. Chandra says Alpha is currently looking at a couple of exit.

“We believe it was the right decision to exit and has maximized the return in that situation. We don’t have any specific target, but we need to be smart in timing the exit of the companies. As a fund, we need to create superior return for our investors,” Chandra says.

As Published in Forbes Indonesia, March 2019 Edition

![[AlphaHub Writing Competition] Experience Can’t Pay Your Actual Bills and That is Why Setting The Boundaries Matters [AlphaHub Writing Competition] Experience Can’t Pay Your Actual Bills and That is Why Setting The Boundaries Matters](https://www.alphajwc.com/wp-content/uploads/2021/11/pexels-monstera-7114349-400x250.jpg)